The Sweetest Investment in 2024, So Far…

Jake Hanley, CMT

Managing Director | Sr. Portfolio Specialist March 19, 2024

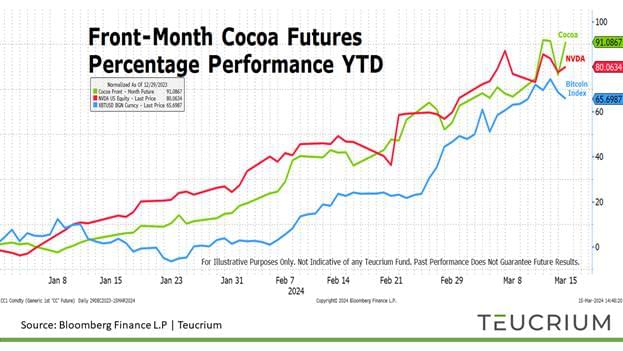

What is the sweetest investment in 2024 so far? It’s not Nvidia, or Bitcoin. It’s cocoa.

Cocoa futures[1] have surged more than 80% YTD as weather-related production issues have led to a supply/demand imbalance.

The Fundamentals

You can blame El Nino[2] for contributing to the weather woes, which have taken a bite out of expected yields in Western Africa, an area responsible for more than 70% of global cocoa production. The International Cocoa Organization (ICCO) reported a 33% drop in cocoa deliveries to ports in Ivory Coast and Ghana year over year. This decrease in production has been further exacerbated by processing challenges, with some plants halting or reducing activities due to the inability to afford beans. Looking forward, the ICCO has projected a widening global cocoa deficit, forecasting a shortfall of 374,000 metric tons for the 2023/24 season. That would equate to a year-over-year drop of 21% in global ending stocks. Clearly a bullish scenario.

The Trade

The future’s curve[3] tells the story. The market is in a relatively steep backwardation[4]; a scenario where the prices of near-dated futures contracts are higher than those for contracts expiring later. This makes sense given near-term supply concerns. Current market pricing reflects an expectation that production will recover, and supplies will begin catching up toward the end of this calendar year. However, if you can’t wait until December to take delivery, and you need cocoa this summer, well, you’re paying up. The July contract is trading at a $1,700 per metric ton premium to the December contract as of 03/19/2024.

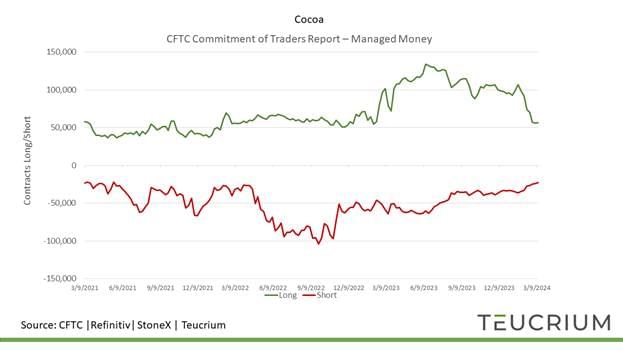

It is not uncommon to see significant price advances coincide with a rush of speculative interest. However, the recent price spike (cocoa futures are up more than 40% since mid-February) has come amid a decrease in the net long position. In-fact, the net long position[5] in cocoa peaked in September 2023 and has been trending lower ever since. This suggests that traders have been taking profits even as prices have continued to rise. Yet, note that short interest[6] has also been in decline. It appears that some traders have been covering losses as well.

For ETF Investors

While Teucrium does not offer a cocoa specific ETF, our long/short[7] agricultural strategy ETF (ticker: OAIA) is currently long cocoa futures. OAIA seeks to track the total return performance, before fees and expenses, of the AiLA-S033 Index, a sophisticated long-short investment strategy in the agriculture sector. In addition to cocoa, the fund may take long and/or short positions in corn, wheat, soybean, coffee, and sugar markets. Investors seeking exposure to cocoa futures or agricultural futures in general, may consider OAIA as a core portfolio holding.

Not to be overlooked is the ability for the index to take short positions. This means that OAIA presents an opportunity for profit regardless of price direction. Cocoa futures prices have been on the rise, and OAIA is currently long cocoa futures. However, it is possible that index will flip resulting in OAIA taking a short position in cocoa. The S033 index follows a rules based quantitative strategy informed by machine learning. Therefore, the decision to take a long or short position is mathematical.

Importantly past performance does not guarantee future results, still the historical index performance is impressive. Since inception in 2017, and through 2023, the average annual rate of return for the index was 14.58%, with an average annual Sharpe ratio of 1.77.[8]-[9] Note that it is not possible to invest directly in an index, and even though OAIA seeks to track the total return performance of the S033 Index there is no guarantee that it will do so.

The Takeaway

Cocoa futures are among the top performing investments in 2024 so far. Recently outperforming both Nvidia stock and bitcoin. While Teucrium does not offer a cocoa specific strategy, investors may consider the Teucrium AiLA Long-Short Agricultural Strategy ETF (ticker: OAIA), which is currently long cocoa futures. What’s more, the strategy can go short as well, offering investors the potential to profit regardless of price direction. You can learn more about OAIA here: https://www.teucrium.com/etfs/oaia

[1] Cocoa Futures: A futures contract is an agreement to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future. Cocoa futures are contracts for the future delivery of cocoa, used as a way for businesses and investors to hedge against price changes in cocoa, a key ingredient in chocolate production.

[2] El Niño: A complex weather pattern resulting from variations in ocean temperatures in the Equatorial Pacific. El Niño events are associated with temperature fluctuations, changes in precipitation, and disruption of weather patterns around the world.

[3] Futures Curve: A graph that plots the prices of futures contracts for a single commodity across different expiration dates. The shape of the curve (e.g., upward, downward) can indicate market expectations about future prices.

[4] Backwardation: A market condition in which futures contracts are priced higher in the short term than in the long term. This typically indicates that the market expects the spot price (current price) of the commodity to decrease.

[5] Net Long Position: The difference between the number of long (buy) positions and short (sell) positions that an investor holds. A net long position indicates that an investor owns more securities or commodities than they owe.

[6] Short Interest: The total number of shares of a particular stock or commodity that have been sold short by investors but have not yet been covered or closed out.

[7] Long/Short Strategy: An investment strategy that involves taking long positions in stocks, futures, or other securities that are expected to increase in value and short positions in securities expected to decrease in value.

[8]Sharpe Ratio: A measure to evaluate the performance of an investment compared to a risk-free asset, after adjusting for its risk. It is the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns.

[9] Performance as reported on AiLA Indices website: https://ailaindices.com/AiLA-S033.php