RSMV

Fund Strategy

The RSMV Strategy ETF is an actively managed exchange-traded fund (ETF) that seeks to achieve its investment objective by investing primarily in common stocks of U.S. growth companies, focusing on large-cap issuers (over $10 billion) but occasionally including smaller companies. It maintains a concentrated portfolio of 20-50 holdings, which may vary by sector depending on market opportunities. The Fund may also invest in ETFs focused on U.S. growth companies. During periods of high volatility, it can hold cash, investment grade fixed income, or U.S. Treasuries for defensive purposes. The Adviser employs a top-down approach to identify momentum driven asset categories and a bottom-up strategy to select securities, prioritizing performance persistence while managing risk and volatility.

Seeking Growth & Disciplined Risk Control

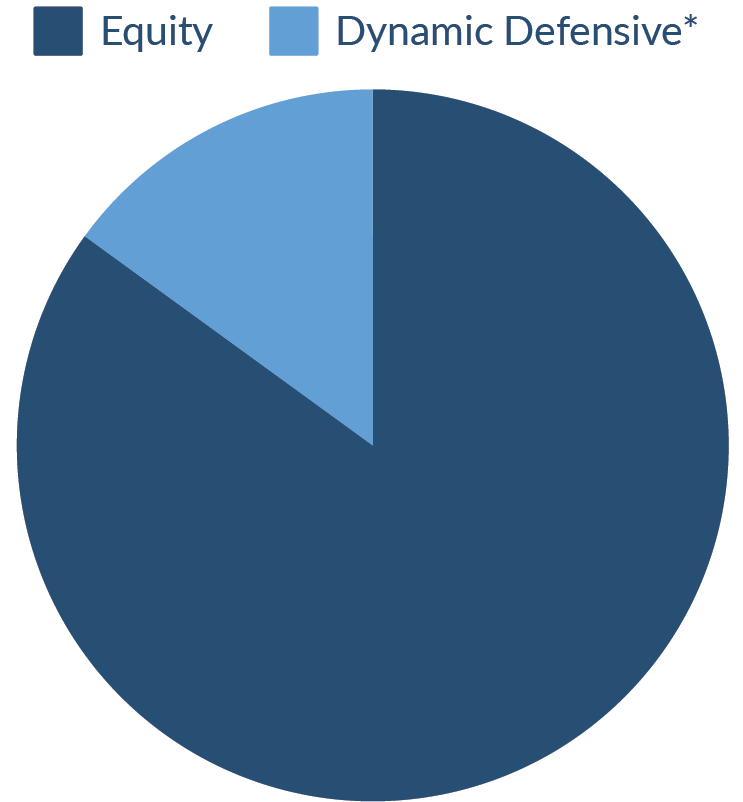

The Relative Strength Managed Volatility Strategy ETF is designed to balance growth potential with risk management. The strategy typically calls for investing in growth stocks and/or ETFs holding some of the largest U.S. companies, and applying a systematic, algorithm-driven process that evaluates relative performance twice a month.

RSMV in Your Portfolio

- Risk Management: For temporary defensive purposes, the Fund may invest without limitation in Treasury securities and high-quality corporate bonds.

- Potential Portfolio Diversification Benefits: By dynamically adjusting equity and bond allocations RSMV may help reduce overall portfolio volatility overtime.

- Core Role: For investors seeking balanced exposure to equities with a focus on potential downside protection, RSMV can serve as a strategic core holding.

*Dynamic Defensive Holdings: The Fund may shift to cash, U.S. Treasuries, or investment-grade bonds during market volatility for defensive purposes.

Fund Facts

| Ticker | RSMV |

| CUSIP | 53656G332 |

| Inception | 01/13/2025 |

| Exchange | NYSE Arca |

| Management Fee | 0.95% |

| Total Annual Expense | 0.95% |

| Distributions | Annually |

| Administrator | U.S. Bank Global Fund Services |

| Distributor | PINE Distributors LLC |

Daily Facts as of TBD*

*subject to change

| NAV | TBD |

| Closing Price | TBD |

| Prem / Discount | TBD |

| 30-day Median Bid/Ask Spread1 | TBD |

| Shares Outstanding | TBD |

| Total Net Assets | TBD |

1 The 30-day median bid/ask spread is the median percentage difference between the highest bid price and lowest ask price relative to the midpoint price over the past 30 trading days.