Sugar Prices Rally: There’s an ETF for That!

Jake Hanley, CMT

Managing Director | Sr. Portfolio Strategist October 25, 2023

Front-month sugar futures have rallied nearly 40% in 2023. Market participants are pointing to production concerns and reduced exports as key factors underpinning the rally. Unfavorable weather tied to the current El Nino climate pattern is taking a toll on sugar production. For investors, the Teucrium Sugar Fund (CANE) offers price exposure to sugar futures prices. What follows is a high-level update on the global sugar market and a closer look at the CANE ETF.

Supply Concerns

Thailand, the second largest sugar producer and exporter, is facing a 30% decline in sugar output. Concurrently, India, another linchpin in the sugar market, has been grappling with repercussions from a sub-par monsoon season, jeopardizing its cane harvest. Given the production issues, the world is facing the potential of a sugar deficit for the second d year in a row. A deficit occurs when consumption outpaces production.

What’s more, in an effort to stabilize domestic price structures, India has extended its export limitations, further tightening the global sugar supply dynamics. India is the world’s third largest sugar exporter accounting for approximately 10% of the global market.

Czarnikow analysts estimate a 2.9 million metric ton deficit for sugar in the 2022/2023 crop year, and are forecasting a 0.9 million metric ton deficit for the current crop year.[1]

Blame the Weather

El Nino conditions have been in place since June this year and is expected to continue into Spring 2024.[1]

El Nino has historically spelled trouble for Thai and Indian sugar producers. The current El Nino pattern is no exception and has resulted in the poor harvest expectations described above.

However, El Nino tends to produce favorable growing conditions for Brazil, the world's largest producer and exporter. Yet, after experiencing three years of La Nina-induced drought, parts of Brazil are still dealing with sub-optimal conditions. Ultimately the health of the global sugar balance sheet will depend on Brazil. Better-than-expected Brazilian production could tip the scales and create a global surplus, conversely, if production lags current estimates, then we would expect to see the deficit widen.

Note that the USDA will release its global sugar market projections on November 21 2023.[2]

There’s an ETF for That

The Teucrium Sugar Fund provides price exposure to sugar futures from a traditional brokerage account.

Sugar is an important commodity and is pervasive across the global economy. Beyond sugar's recognized role as a sweetener, its applications extend to ethanol production, biomaterial synthesis, and alcohol manufacturing. As such it is very much a staple in our everyday life.

Sugar in Your Portfolio

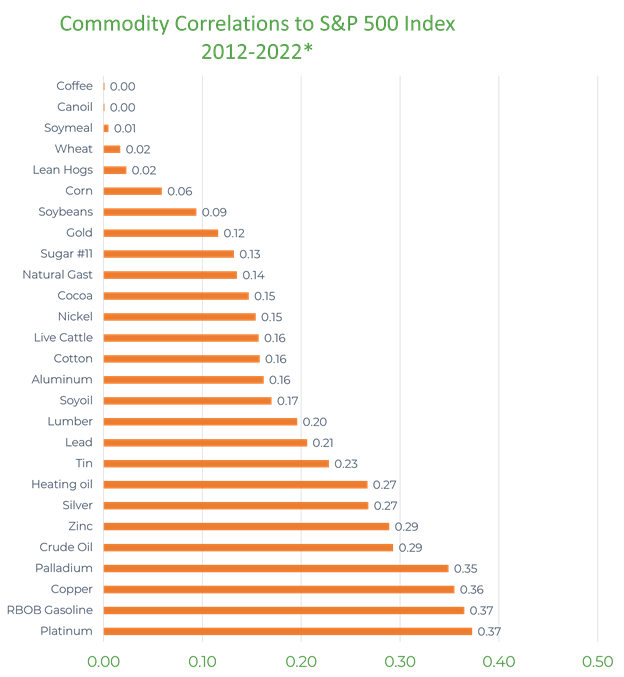

Sugar futures prices have low historical correlations to stocks. As such investors looking to craft a more resilient and diversified portfolio might consider CANE.

![]()

Source: Bloomberg Finance, L.P. See Appendix for additional information.

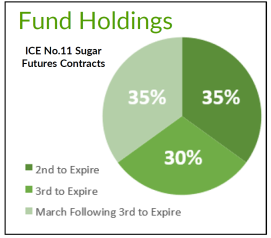

Additionally, the volatility in the sugar markets presents an opportunity for nimble investors to take short-term tactical positions in the fund. Note that CANE is designed to track Teucrium’s proprietary long-only benchmark. The strategy is designed to help mitigate the impacts of contango by balancing exposure across the futures curve by investing in three separate contracts.[4]

Benchmark Allocation:

The Price Tells the Story

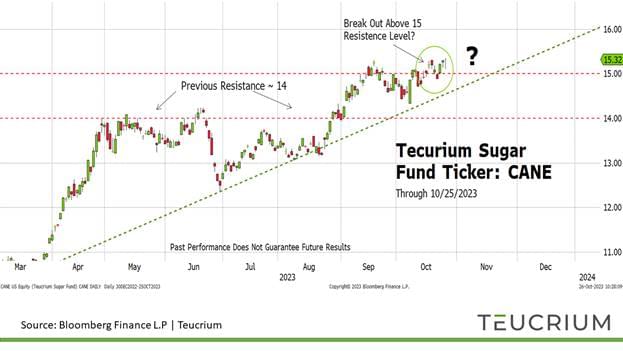

CANE currently holds the May 2024, July 2024, and March 2025 sugar futures contracts. The fund’s market price has recently moved back above $15 and on 10/25 closed at a new 52–week high. The fundamentals suggest that there may be room for prices to run higher. There is certainly some momentum behind the rally as evidenced by the fund notching another 52-week high.

Still, should the fund stall around $15 it may be a signal from the market that the supply concerns are fully priced in, and/or the global balance sheet may be in better shape than we think.

Past Performance Does Not Guarantee Future Results. Candlestick charts display the high, low (stick), open, and closing prices (body) of a security for a specific period. Red represents a negative return for the day. Green represents a positive return.

Final Thoughts

The sugar market has witnessed substantial volatility in 2023, with prices surging by 40% due to a myriad of challenges from erratic weather patterns to production concerns in key producing nations like Thailand and India. The ongoing El Nino conditions further complicate the global sugar supply dynamics, putting a spotlight on Brazil's potential to influence the global sugar balance.

Amidst these complexities, the Teucrium Sugar Fund (CANE) emerges as a notable instrument for investors, offering exposure to sugar futures prices. With sugar's pivotal role in the global economy and its low correlation to stocks, the CANE ETF presents an intriguing option for investors seeking diversification and the potential for tactical positioning in their portfolios.

The forthcoming USDA report on November 21, 2023, will be a key date to watch, potentially providing further insights into the future trajectory of the sugar market.

Appendix:

Description and identification of Commodities Used in Correlation Analysis