More Bellies, Richer Tastes

Teucrium | November 9, 2022

A Recent History of Global Grain Demand

Jake Hanley, CMT

Managing Director, Sr. Portfolio November 9, 2022

Global demand for corn, wheat, and soybeans skyrocketed between 1980 and 2020, growing more than 143%. That is a significant increase, but it is no surprise considering that corn, wheat, and soybeans (referred to simply as grains from here on) are not just food, but key ingredients in many products we consume every day.

For example, corn is primarily used to feed livestock, but it is also used to create ethanol which is blended with gasoline. Corn starch is used to bind paper. Wheat is mostly grown for human consumption, but it is also used as an ingredient in particle boards. Even soybeans, which are typically fed to animals or crushed for cooking oil, are increasingly cultivated for use as a biofuel. These are only a few examples of the multi-purpose use for grains.

Grains are pervasive throughout the global economy. Therefore, it is no surprise that even with today’s elevated prices, demand shows little signs of slowing. The two fundamental drivers behind grain demand are population growth and a burgeoning global middle class.

Population

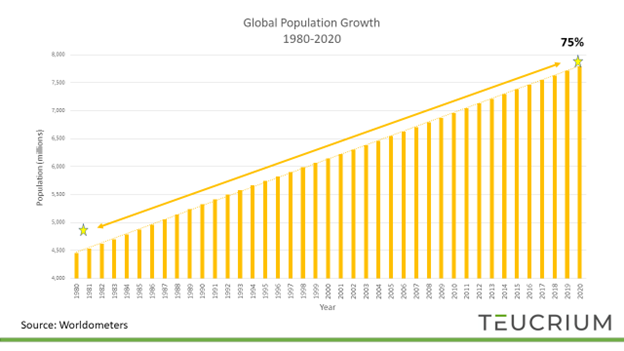

Over 3.3 billion people were added to the planet between 1980 and 2020. If you lived through the Carter administration, then you can recall a time when Earth was 75% less crowded.

Chart #1

More people equates to more demand for just about everything. It absolutely means more demand for food.

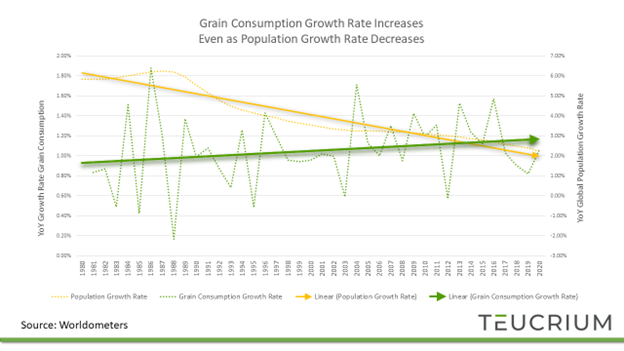

Note, however, that the annual global population growth rate has slowed to 1.05% in 2020 versus 1.77% in 1980. That’s a meaningful slowdown. Even so, the annual growth rate of grain consumption continues to trend higher.

Chart #2

Even as the rate of population growth slows, there are still more people consuming more grain. In fact, per-person grain consumption jumped 40% in the 40-year period between 1980 and 2020.

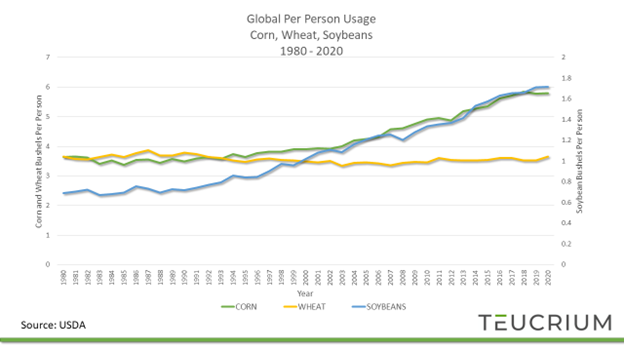

Chart #3

As you can see on chart #3 above, the increased consumption is showing up in the corn and soybean markets, whereas wheat consumption has held steady for the past 40 years. The increased corn and soybean consumption makes sense when you consider the other primary factor driving demand: the expanding global middle class.

The Global Middle Class

In 2018 humanity crossed an exciting milestone. For the first time in history, the majority of people on the planet were considered middle-class.[1] This is perhaps the most under-reported good-news story of our time. There is no global standard by which to measure the middle class, however, Homi Kharas, Senior Fellow at the Brookings Institute, offers a compelling approach. Mr. Kharas measures the middle class based on households whose spending is between $11 and $110 per capita per day.[2] People in this group have discretionary assets, i.e. the economic freedom to choose how to spend their money.[3]

As people move from sustenance living to join the middle class, a common choice is to incorporate more animal protein into their diets. As demand for animal protein rises so too does demand for grain to feed livestock.

Recall from chart #3 above that per-person wheat consumption has remained steady over the past 40 years, yet per-person corn and soybean consumption has grown rather significantly. Corn and soybeans are both primarily used as animal feed whereas wheat is primarily consumed by humans. Therefore, it’s no surprise that as meat demand increases, so too does the demand for corn and soybeans.

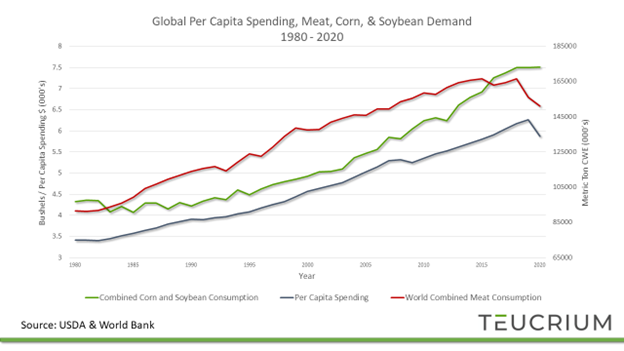

Chart #4 below shows global per capita spending, combined meat consumption (beef, veal, swine), as well as combined corn and soybean usage. Note that the data is through 2020. The COVID-19 pandemic took a bite out of consumer spending and global meat consumption. Still, the global average per capita spending was more than $16[4] per day in 2020 above the middle-class minimum of $11 per day.

What’s more, meat demand has since rebounded. Current estimates for 2023 place combined meat consumption back above 156 million metric tons.

Chart #4

With history as a guide, it is reasonable to expect that as the global middle class grows so too will demand for animal protein. As meat demand increases so too does grain demand.

Meeting Demand

The world’s population is increasing, and the global middle class is expanding. This is fundamentally supportive for continued growth in grain demand. Yet, while increasing demand for grain is all but a foregone conclusion, grain production, and therefore supply, remains highly variable. Production does not always keep pace with demand. As we have seen recently, a dwindling supply in the face of robust demand results in higher prices.

Despite their best efforts, farmers across the globe have been struggling to replenish global supplies. Bad weather, higher input costs, and war in Ukraine are all major headwinds to grain production.

Yes, the world is in turmoil.

What does it mean for global grain prices moving forward?

Stay tuned.

Subscribe to our newsletter and stay up to date on matters related to investing in food commodities.

#Foodmatters

[1] https://www.brookings.edu/blog/future-development/2018/09/27/a-global-tipping-point-half-the-world-is-now-middle-class-or-wealthier/

[2] In 2011 dollars. Source: https://www.brookings.edu/wp-content/uploads/2021/09/DollarAndSense_Transcript_Kharas_GlobalMiddleClass.pdf

[3] Note that Mr. Kharas uses spending rather than income when measuring the middle class. This is important because a person with little or no income may be wealthy and could spend from savings. Additionally, someone with limited income may be receiving financial support from family members which allows them to live a lifestyle consistent with a middle-class experience.

[4] Measured in 2015 Dollars. https://data.worldbank.org/indicator/NE.CON.PRVT.PC.KD?end=2021&start=1960&view=chart