A World in Turmoil

Teucrium | September 27, 2022

Implications for Global Food Prices

Jake Hanley, CMT

Managing Director, Sr. Portfolio September 27, 2022

Introduction

Everything has changed.

The policy response to the global COVID-19 pandemic altered the course of history. Widespread Government lockdowns culminated in a global economic shutdown. We have been dealing with and will be dealing with, the pandemic’s consequences for decades to come.

The pandemic brought to the surface an undercurrent of pre-existing socioeconomic trends. For example, the lockdowns forced companies to invest in “remote work” capabilities. It’s safe to say that there are many more remote workers today than there would have been if not for the lockdowns.

Likewise, the lockdowns helped accelerate trends in the global agricultural markets. Ag markets are heavily interwoven with geo-politics, and you may have noticed, international relations have been wobbly for some time. Supply chains, trade agreements and indeed globalization itself, was already on shaky ground pre-pandemic. When the world’s largest economies locked down, that shaky ground became an outright earthquake.

Many of the challenges facing global ag markets are man-made. That’s a good thing, in that, if willing, man can fix a man-made problem. Still, there are some challenges such as weather, that are largely beyond our control. Furthermore, if policy leaders prove unwilling to cooperate, then our man-made problems might be made worse.

We’re already seeing nations turn toward more protectionist policies. As global food supplies dwindle the haves (i.e. net exporting nations) and have-nots (i.e. net importing nations) often find themselves at odds. Tighter supply means fewer exports. Unfortunately, this can result in food scarcity. Food scarcity has a way of giving way to political instability, which can devolve into larger-scale conflict.

In some instances, conflicts may become kinetic, that is, turn into hot wars. Look no further than Russia’s invasion of Ukraine for example. Of course, the war in Ukraine is not solely about food, but it’s a big part of the story.[1]

In one sense, everything has changed. The world of globalization and interdependence among nations is reverting toward regionalization and protectionism. It appears that the globe is quickly devolving to a place where nations struggle against one another for control of land and vital resources. In that sense, to quote David Byrne, “…it’s the same as it ever was.”

The Series

In this series, we will explore the macro dynamics impacting global supply, demand, access, and availability of food. We’ll examine facts and trends to help inform our market view, and we will respond to the key question on investors’ minds: what’s in store for agricultural prices?

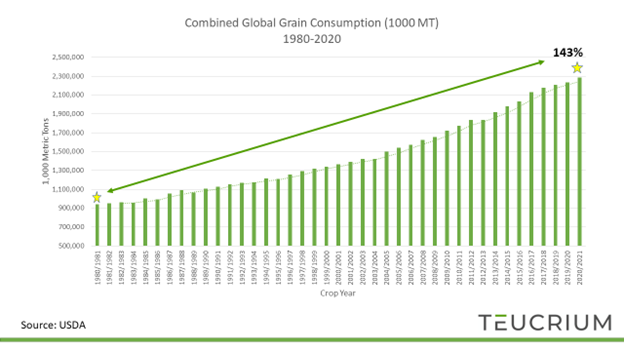

In the first part of our series, we will begin by examining the global increase in grain demand. The numbers are staggering: 143% growth in combined corn, wheat, and soybean consumption in the past 40 years!

What is driving demand? Population growth? Expanding global middle class? Dietary changes? Spoiler alert, it’s all the above, and more.

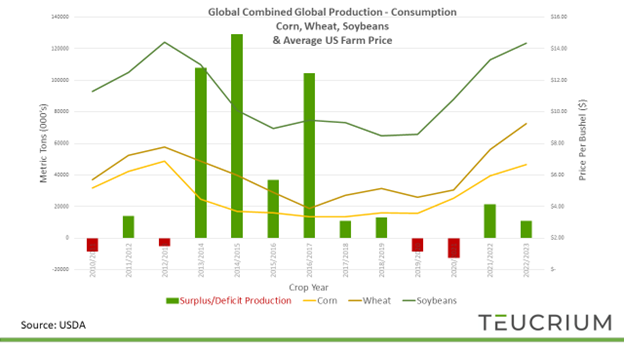

Next, we’ll explore the supply side of the equation. There are a myriad of forces impacting global grain production including weather, government policy, and input prices, among others. Variations in farmer output means that production does not always keep pace with demand. Historically, during such periods, prices have accelerated to the upside.

Chart: The green bars reflect years when farmers produce more grain than is consumed. The excess production is stored to be used during years when production fails to keep pace with consumption (deficit years). The deficit years are reflected in red bars. The lines represent the average selling price per bushel for US corn, wheat, and soybeans farmers.

As you can see on the chart above, corn, wheat, and soybean prices have all recently traded back near 10-year highs. The price action reflects the tightness in global grain balance sheets as supplies have been drawn down due to elevated consumption relative to production.

Stay Tuned

In summary here’s what we know (working backward through the above commentary):

Grain prices have already reached near-decade highs as demand remains robust and production has not been keeping up. Global grain balance sheets remain tight. This has led to scarcity in food insecure nations. Scarcity can breed political instability; we’ve already witnessed the outbreak of war between Russia and Ukraine. Protectionist policies are emerging as the world devolves from globalization to regionalization.

Yes, the world is in turmoil.

What does it mean for global agricultural prices?

Stay tuned.

Subscribe to our newsletter and stay up to date on matters related to investing in food commodities.

#FoodMatters

[1] Prior to the war Ukraine was a top 5 global exporter of both corn and wheat. Eastern Ukraine consists of some of the most fertile soil on the planet.