Ukraine Black Sea Shipments Resume

Teucrium | August 18, 2022

Now What?

Jake Hanley, CMT

Managing Director, Sr. Portfolio August 18, 2022

There have been 2 major developments in global wheat markets in the past 6 months. The first was the Russian invasion of Ukraine. The second was the resumption of Ukrainian grain shipments via the Black Sea. The Russian Invasion took the markets by surprise. However, while we at Teucrium remain skeptical of the Istanbul Grain Accord, the resumption of Ukrainian wheat exports via the Black Sea seems to have been largely priced into the market ahead of time.

Financial markets are, by nature, forward-looking. In the world’s most liquid markets, such as the wheat futures market, a price chart can typically be thought of as a picture of the fundamentals. That is to say that price reflects the supply and demand dynamics of the market.

Still, the fog of war is thick, and the war rages on. While the Grain Accord is a positive development and should help reduce global food costs, it does nothing to stop the Russian invasion of Ukraine. We expect grain prices in general, and wheat in particular, to remain volatile for some time.

The Surprise

The Russian invasion of Ukraine surprised the wheat market. The proof is in the price action.

On January 18th, then White House Press Secretary Jenn Psaki stated that a Russian invasion of Ukraine could happen “…at any point.” That caught our attention, and we immediately published our own note on the potential conflict (available here). Yet few, if any, heeded the warning.

Approximately one month later Russia invaded Ukraine clearly catching the trade off-guard.

Ukrainian defenses deployed sea mines around key port areas to slow and deter Russian Naval forces and the Russian Navy established what amounted to a blockade. Recognizing that roughly 1/3rd of the world’s wheat exports come from the Black Sea Region the trade got spooked. As the shooting started markets began pricing in the worst, with front-month wheat prices jumping nearly 70% over the next 6 trading sessions.

No Surprise?

Yet, the market was not surprised by the resumption of Ukrainian grain exports via the Black Sea. Again, the price action tells the story.

On May 19th, US Secretary of State Anthony Blinken stated that “the decision to weaponize food was Russia’s and Russia’s alone.” Around the same time, Russia began indicating that they were in support of establishing “humanitarian corridors” in an effort to get grain moving via the Black Sea. Wheat prices sank more than 15% over the next three weeks (05/16-06/03) and continued trending lower through most of July.

Appearing to follow the adage “sell the rumor buy the fact,” front-month wheat prices closed at a near-term low on July 22nd, the same day a deal was signed allowing for the export of Ukrainian wheat via the Black Sea. Prices, by and large, have been moving sideways ever since, roughly between $7.50 and $8.45. The price action suggests that the resumption of Ukrainian wheat shipments via the Black Sea to a large extent may have already been priced in.

This chart is for illustrative purposes only. Front-Month Wheat Futures 08/18/2021 -08/18/2022. Source: Bloomberg Finance L.P. Pas performance does not guarantee future results. For this purpose, wheat commodity values are representative of the futures (generic first wheat futures contract - <W 1 Comdty>) spot continuation chart as defined by and sourced on Bloomberg: Generic contracts, such as W 1, W 2, W 3, ..., are constructed by pasting together "rolling" contracts, according to the pre-selected roll types on the commodity default page. The generic contract uses the value of a particular contract month until it "rolls" to the next month in the series. You can access a generic contract by replacing the month/year code with the number 1, i.e. W 1<CMDTY>. Replacing the month/year code with the number 1 will yield the spot contract.”

Yet, there could be additional downside as the market becomes increasingly confident in the success of Ukrainian shipments. Keep in mind that wheat prices are still elevated relative to history. Yes, the wheat balance sheet is tight (i.e. high demand relative to supply) and is expected to tighten further this year. That is seen very clearly in the global stocks/use ratio[1] which as of the August WASDE report sits at approximately 34.11%. This is the lowest the global stocks/use ratio has been since the 2015 – 2016 crop year. However, front-month Chicago wheat futures spent much of ’15-‘16 trading between $4.50 and $5.00 per bushel.

This suggests that there may still be an “uncertainty premium,” built into the market. And for good reason…

…The War Rages On

Increased shipping traffic in the Black Sea is a positive development. With global food prices rising well before the onset of war, lack of access to Black Sea exports made a bad situation worse. At Teucrium, we remain skeptical of the Istanbul Grain Accord. We had struggled to understand why Russia would agree to allow Ukrainians access to the Black Sea. On the surface it seemed to us that Russia was negotiating away a major strategic advantage. That said, it’s now clear that Russia is a clear beneficiary of the deal as well.

Russia Exports

It's important to note that up to approximately 90% of all Russia agricultural exports ship via the Black Sea.[2] Russian wheat exports are behind the projected pace this year, down approximately 28% versus last year. The slower pace is in part due to a reluctance on the part of shipowners to enter Russian ports.[3]

The Istanbul Grain Accord provides a security guarantee for commercial ships transiting to and from Ukraine ports. This is helping to encourage shipping activity and bring costs down for the entire Black Sea. This is helping to increase the pace of Russian exports.

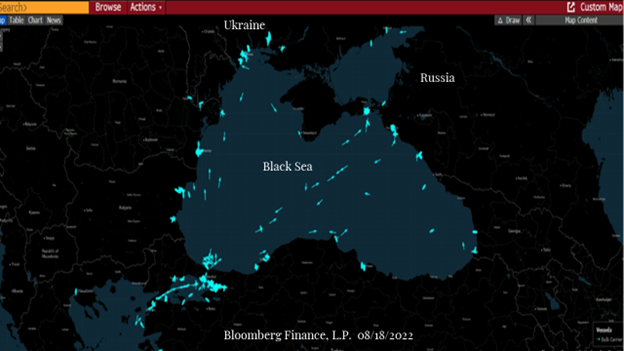

The map below shows the shipping activity for Dry Bulk Vessels which are used to ship grain. Note the traffic to both Ukraine and Russia.

Bloomberg Finance L.P. Map Created 08/18/2022. Blue arrows represent dry bulk shipping vessels which are typically used to transport grain. The arrow indicates the vessels latest known position and heading.

Additionally, the agreement includes a commitment by the West to refrain from sanctioning Russian food or fertilizer exports. There were not any public plans to do so (typically food is exempt from political sanctions), however, now the Russians have it in writing.[4]

Finally, recent reports indicate staggering Crimean wheat production which is coming in approximately 70% above the 5-year average.[5] Hats off to the Crimean wheat farmers if they were truly able to more than double production per hectare year over year. However, with reports of Russians stealing Ukrainian grain, it is likely that stolen Ukrainian grain is making its way to Russian-controlled Crimea for export via the Black Sea.

Russian Military Objectives

While the agreement is a positive development and is already helping to push global food prices lower, this agreement does nothing to curtail Russian military objectives. Russia has stated that they want to completely “liberate,” the Donbas region. They are close to accomplishing this objective. But the Russians are unlikely to stop there. We believe that they want to control Ukraine’s entire Eastern seaboard.

This of course includes the port city of Odessa. Under the recent Grain Accord, Russia has promised not to attack any port while grain is in transit. Therefore, Odesa may be spared for now, yet it is likely only a matter of time before Russia attempts to advance Southwest from currently occupied Kherson.

The Ukrainians are putting up a good fight. Their bravery is commendable, and they are giving the Russians a hard time to say the least. Western military aid has certainly helped, however, it’s not likely to be enough to fully repel the Russian advance. The Ukrainian forces are outmanned, outgunned, and outmatched.[6] Unless Western allies get involved militarily, it is only a matter of time, blood, and money before Russia conquers all of Eastern Ukraine.

Conclusion

The Russian invasion of Ukraine took the global wheat market by surprise. The resumption of Ukrainian Black Sea shipments seems to have been largely priced in. With US wheat prices back below pre-war levels, one is left to wonder what other surprises might still be in-store.

We remain skeptical of the long-term success of the Istanbul Grain Accord. Russia does not appear to be letting up on their goal of occupying Eastern Ukraine. This likely includes all major port cities along the Eastern seaboard. As long as the shooting continues, we expect volatility.

Options are available on the Teucrium ETFs. Please contact your broker and/or financial advisor for more information.

[1] Stocks/Use Ratio: Ending stocks divided by total usage, whereas Ending Stocks (also called carry-out) represents the amount of a crop that will be available at the end of a crop year given the estimated or actual beginning stocks, production, and usage.

[2] https://www.mei.edu/publications/russia-black-sea

[3] https://www.spglobal.com/commodityinsights/en/market-insights/topics/food-inflation-security

[4] https://www.rferl.org/a/russia-sanctions-fertilizer-grain-exports-clarification/31944494.html

[5] www.blackseacropforecast.com - https://twitter.com/GreenSquareAC/status/1558000232054620160?s=20&t=pnvkFih2-N6g-oMcwotuHw

[6] https://www.globalfirepower.com/countries-comparison-detail.php?country1=russia&country2=ukraine