Busting the Blockade

Teucrium | June 15, 2022

Weaponizing Wheat

“The decision to weaponize food is Moscow’s and Moscow’s alone.”

– US Secretary of State Antony Blinken

US Sec. of State Antony Blinken addressed the United Nations on Thursday May 19th, and accused Russia of holding “hostage” global food supplies. Russia’s blockade of the Black Sea has crippled trade in the region. Sec. Blinken noted that there are some 20 million metric tons of grain held up in Ukrainian storage. Yet, the inaccessibility of these supplies is likely already priced into the market.

Pricing Uncertainty

Consider that the global wheat stocks/use ratio is 26% compared to the 10-year average of 34%. 26% matches the stocks/use ratio from the ’12-’13 crop year. Note that wheat prices peaked at $9.4725 in 2012. As of this writing, front-month wheat futures are trading over $11.

Wheat prices would likely head lower if the Ukrainian supply was made available. Russia recently announced that they are willing to open “humanitarian corridors” for grain shipments out of the Black Sea. That willingness carries the caveat that Western sanctions against Russia be lifted.

Absent Russia’s willingness to cooperate, Western nations may opt to take it upon themselves to establish “humanitarian corridors.”

The Foreign Minister of Lithuania, Gabrielius Landsbergis recently told the Guardian newspaper that he is seeking a coalition “of the willing,” to send warships to the Black Sea. Estonian President Alar Karis, told Bloomberg that “…it’s a humanitarian crisis…if the grain doesn’t get out of the country.” As such Karis sees the “U.K. and some others,” potentially joining the coalition.

However necessary, Western nations are walking a fine line. Russia may perceive the deployment of warships to the Black Sea as an act of aggression. What’s more, with tensions already high, such a scenario could result in a grave “accident,” much like the sinking of the Lusitania in 1917.

In either scenario, it is difficult to gauge how much food may be made available and in what time frame. Ukrainian ports have suffered significant damage and repairs will be costly and time-consuming. Additionally, naval mines will need to be cleared prior to the resumption of commercial shipping.

Still, the potential to get some food out of the Black Sea region is a welcome development. Near-term wheat prices may turn lower as markets price in the availability of wheat via the Black Sea even though many long-term challenges remain.

Fundamental Damage Done

The USDA estimates that the War will result in a near 50% drop in Ukrainian wheat production in ’22-’23. This level of loss is seen weighing on the global wheat balance sheet, which the USDA sees shrinking for the third year in a row. What’s more, global wheat demand is expected to remain robust, falling less than 1% from last year’s record. Fundamentally, lower supplies and steady demand should be supportive for wheat prices.

A Friendly Trend?

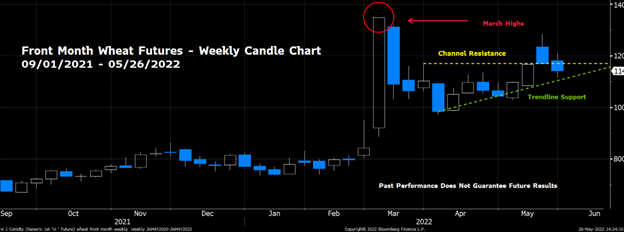

Front-month wheat futures prices have been trending higher over the past few weeks. The green dotted line on the weekly candle chart below indicates near-term trendline support. Yet, the front-month contract has yet to make a weekly close above $11.69 (yellow dotted line). If prices move above the yellow dotted line, then a retest of the March highs may be in the cards. Alternatively, a break below trendline support would likely set the stage for further selling and lower prices.

Source: Bloomberg Finance L.P. and Teucrium. Generated on 05/26/2022. This chart is for illustrative purposes and is not indicative of any investment. Past performance does not guarantee future results.

High Prices, Relatively Speaking

The tight global balance sheet is providing fundamental support for the idea that prices may remain elevated for an extended period. Elevated, that is, relative to recent history. Note that wheat prices spent much of the last decade trading between $4 - $6 per bushel. Given the current supply-demand dynamics, it is unlikely that prices head back to those levels any time soon. However, prices could very easily move back below $10 per bushel and still be considered elevated.

Source: Bloomberg Finance L.P. and Teucrium. Generated on 05/26/2022. This chart is for illustrative purposes and not indicative of any investment. Past performance does not guarantee future results.

Headline Risks & Volatility

Wheat remains in a war-time market. As such, there will be some market participants looking to trade the headlines. Short-term market gyrations, reacting to headlines, can leave many fundamental investors scratching their heads. Fundamentally, supplies are tight which supports higher prices. Current prices are elevated and much of the bad news (i.e. inaccessibility of Ukrainian wheat), is likely already priced into the market. Opening up a “humanitarian corridor” may put downward pressure on prices in the near term. Alternatively, Western warships entering the region could result in a very tense situation, increasing overall market uncertainty, and potentially leading to even higher prices.

Either way, we expect prices to remain volatile. Note that options are available on the Teucrium Wheat Fund (WEAT); please consult your broker.

Please read the prospectus and carefully consider the investment risks prior to investing.