TAGS or TILL

Teucrium | May 25, 2022

A New Strategy from Teucrium

TAGS or TILL

Which Strategy May Be Best for You?

For investors looking for price exposure to multiple agricultural markets in one fund

Two Teucrium funds for consideration:

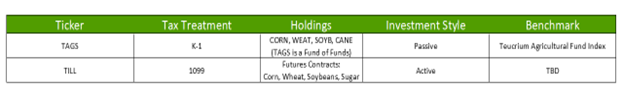

1. The Teucrium Agricultural Fund Ticker: TAGS

TAGS is a passively managed fund of funds, owning each of our single-commodity ETFs (CORN, WEAT, SOYB, CANE), in equal weight. TAGS is registered under the Securities Act of 1933. As such investors receive a K-1 tax form at the end of the calendar year. TAGS seeks to generate returns in keeping with the underlying index, the Teucrium Agricultural Fund Index, which is equally weighted to CORN, WEAT, SOYB, and CANE. TAGS has a 10-year plus track record dating back to the inception date of 03/28/2012.

2. The Teucrium Agricultural Strategy No K-1 ETF: TILL

TILL is an actively managed fund and will hold one[1] futures contract in each of the following markets: corn, wheat, soybean, and sugar. As the name implies, TILL will not issue a K-1 tax form. As a fund registered under the Investment Company Act of 1940, investors can expect to receive the more common 1099 form come tax time. TILL seeks to deliver investors price exposure to corn, wheat, soybean, and sugar futures markets. The fund managers have discretion in regard to contract selection and will follow a proprietary method for choosing the contract they believe will be most beneficial given the structure of the futures curve. The fund aims to maintain an approximate equal weighting between the four markets.

Similar but Different

TAGS and TILL are similar funds in that they provide investors exposure to the same four agricultural futures markets (corn, wheat, soybeans, and sugar). A key difference is in the tax treatment. TAGS issues a K-1 tax form whereas TILL issues a 1099. We understand that there are some brokerage platforms that do not allow investors to hold funds that issue K-1 tax forms. Therefore TILL may be the right solution given it provides agricultural market exposure and issues a 1099.

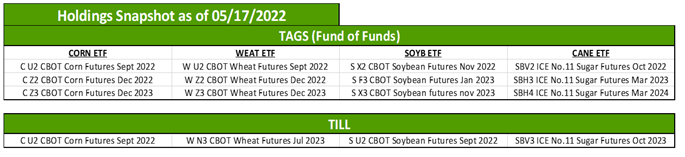

Additionally, we believe that fund performance is likely to vary between the strategies, given the difference in portfolio holdings. For example, notice in the chart below that TILL holds the July 2023 Chicago Wheat contract. Whereas TAGS, holds the WEAT ETF, thereby providing exposure to September 2022, December 2022, and December 2023 Chicago Wheat contracts.

Example of fund holdings as of 05/17/2022

Fees and Expenses[2]

TAGS’ expense ratio is 0.13% as of the prospectus filing April 7, 2022. Note however that TAGS is a fund of funds. Therefore, the investor is also paying the fees and expenses in the underlying funds as well. For example, as of latest prospectus filings in 2022 the expense ratios for the underlying funds are as follows: CORN 1.14% WEAT 1.14% SOYB 1.16% CANE 1.14%

Given that TAGS seeks to hold each fund in equal weight, the estimated expense is 1.275%.[3]

TILL’s expense ratio is 1.49%. Give that TILL holds futures contracts directly there are no additional fees imbedded in the underlying holdings.

Either / Or

Investors looking for price exposure to the world’s largest traded agricultural commodities may obtain that exposure through TAGS and/or TILL. For some, the tax treatment may be the deciding factor leading to an investment in TILL (1099) vs. TAGS (K-1). Others may prefer TILL as an actively managed fund whereby the contract selection is left to the discretion of the fund managers. Over time, we expect the performance and risk profiles of the two funds to be similar but different. One may prove to be more or less volatile than the other; yet, only time will tell.

[1] The fund may hold more than one contract in a particular market during a roll period.

[2] Fund expense ratios are published on the specific fund page on our website www.teucrium.com. Please read the fund prospectus for a description of fees and expenses.

[3] As of the latest prospectus filings and published expense ratios on 05/18/2022