War and Weather

Teucrium | April 19, 2022

Buckle up

Jake Hanley, CMT, Managing Director / Sr. Portfolio Strategist

Make no mistake about it, the Russian invasion of Ukraine was a surprise. The volatile price reaction in wheat futures markets is proof. While the "fog of war" has thinned, the conflict is dragging on and there is still the risk of further escalation.

Ukraine Update

Presently Ukraine’s grain exports are hobbling around 20% of their normal volume. Seaborne routes are all but shut down and rail capacity is limited.[1] What's more, Russian forces have reportedly used "cluster munitions" to spread explosives over vast areas. There is a major initiative underway to scour and "de-mine" roughly 116,000 square miles. De-mining efforts may inhibit planting progress in some regions.

The bottom line: markets can expect a 39% drop in the corn harvest, and a 45% decrease in the wheat harvest this year.[2] A reduced harvest is one thing, getting the grain out of the country is another. As time progresses, the fog will thin somewhat, but major uncertainties will remain far into the future.

Weather or Not

On March 8th we put out a note titled "Corn May be Next." In it, we pointed out that before the War Ukraine was expected to account for 16% of global corn exports. Given shipping challenges and reduced harvest expectations, Ukraine is not likely to come close to those export levels. Corn futures prices have been moving higher over the past few weeks as markets price in this new reality. As of this writing (04/14/2022), front-month corn futures are trading around 10-year highs.

Source: Bloomberg Finance L.P. and Teucrium Created 04/19/2022. This is for illustrative purposes only and not indicative of any investment. Past performance does not guarantee future results. For this purpose, corn commodity values are representative of the futures (front month Corn C 1 2022 corn futures contract - <C 1 Comdty>). The vertical axis shows the price of the contract in 1/100 of a dollar.

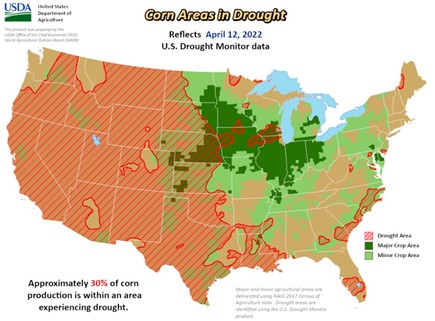

Yet, the next bout of price volatility is likely to come from good 'ol-fashioned weather. As of April 12th, 30% of US corn-producing area was experiencing drought. We know that "rain makes grain." Corn prices may receive additional support if the drought worsens and/or spreads.

What's more, the USDA expects that US corn acreage plantings will be their lowest in 4 years. Blame high fertilizer prices, as farmers say they'll plant soybeans instead. Soybeans do not require as much fertilizer as corn. Recent price moves suggest that some farmers might change their minds and plant corn. Yet, analysts with whom we speak expect a change of only 1 million acres or less.

Planting and Crop Progress

The USDA is back to releasing weekly crop progress reports. Presently we are tracking the winter wheat crop condition and corn planting progress. We'll be sharing those updates on social media. Follow us on Twitter - @TeucriumETFs, and LinkedIn - Teucrium ETFs.

The markets will continue to focus on Ukraine and weather for the foreseeable future. While the storyline will not be changing, the data will be. We'd expect prices to face downward pressure if there is peace in Ukraine and if favorable weather develops in the US. Prices can come down just as fast as they rise, if not faster.

At the risk of sounding like a broken record, EXPECT VOLATILITY. Stay sharp.

Options are available on Teucrium's ETFs, including TAGS (Teucrium Agricultural Fund) our diversified offering. Please consult your financial advisor and/or broker for additional information.