Teucrium: Investor Education Series

Teucrium | March 15, 2022

Jake Hanley, Managing Director / Sr. Portfolio Strategist March 15, 2022

This is the third in a series of short educational commentaries that we plan to release to help better educate the investing public at large.

Given the recent volatility in commodity markets in general, and grain markets in particular, we’d like to review the concept of the futures curve as well as the terms contango and backwardation.

We will begin with brief definitions and then move on to an example illustrating why these concepts matter to investors.

If you have any questions or if you have ideas for additional educational topics, please feel free to email them to us at contact@teucrium.com

Thank you.

The Futures Curve

Futures contracts expire. A futures curve can be seen when graphing multiple futures contract prices over several expiration dates. When the further dated contracts are more expensive relative to the near dated contracts the market is said to be in contango (also known as carry in the grain markets). When the further dated contracts are less expensive relative to the near dated contracts the market is said to be in backwardation.

.png)

This chart is for illustrative purposes only and is not indicative of any investment

.png)

This chart is for illustrative purposes only and is not indicative of any investment

Why it Matters (Teucrium Wheat Fund for Example)

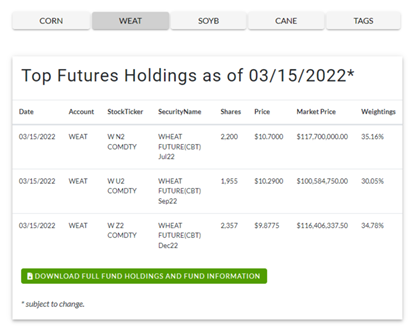

The Teucrium Wheat Fund, ticker: WEAT, invests in wheat futures contracts traded on the CME. The fund is diversified across the curve owning three different wheat futures contracts. Per the benchmark the holdings are as follows:

2nd to expire futures contract (35%)

3rd to expire futures contract (30%)

December following the 3rd to expire contract (35%)

The grain markets are typically in a state of carry (contango). To understand why consider the following example: Flour company X needs to buy wheat to grind into flour. Company X wants to lock in today’s prices but does not want to take delivery of the wheat until December. As such, company X buys the December futures contract. Let’s assume farmer Y is the seller of the futures contract. Farmer Y is now obligated to deliver the grain in December. Yet farmer Y must pay for storage and proper maintenance of the grain until delivery. Fortunately for farmer Y the storage and maintenance costs are built into the price of the December futures contract.

All else being equal longer dated contracts trade at higher prices versus near dated contracts to compensate the seller for “carrying costs” associated with storing and maintaining the grain.

There are times, however, when supply concerns result in higher near-term contract prices relative to longer dated contracts. The backwardation in the futures curve reflects near term supply concerns.

The Chicago Wheat Futures market is currently in backwardation as of this writing. You can see this reflected in the closing prices of the contracts owned by the WEAT fund on 03/14/2022:

WEAT fund holdings information are available on our website here: https://www.teucrium.com/holdings/weat

Information is subject to change and is not a guarantee of future results

Roll With It

Note that per the benchmark WEAT does not own the front-month futures contract. Therefore, the fund sells the 2nd month holding prior to it becoming the front month. The proceeds from the sale are used to purchase a new contract according to the benchmark. This process is referred to as “rolling.”

In a carry market the proceeds from the sale of the near dated contracted will be used to purchase a longer dated contract at a higher price. As a result of the roll the fund will own fewer new contracts, relative to the number of contracts sold when the market is in contango. When markets are in backwardation the proceeds from the sale of the near by contract purchase a larger number of contracts in the further dated contract. In either case the notional value of the trade (i.e. the dollar amount sold and bought) is the same after adjusting for slippage and trading commissions.

The full roll schedule for all Teucrium funds can be found here: https://www.teucrium.com/assets/pdfs/Teucrium_Roll_Dates.pdf

About Teucrium

Our mission is to make it easier for investors to gain price exposure to alternative investments. We believe investors can build more resilient portfolios by diversifying across capital markets and allocating to a variety of different asset classes.

Listed on the New York Stock Exchange, our funds deliver alternative market access through a brokerage account.

Experience Matters

The Teucrium Team has over 70 years of combined trading experience. Since our founding in 2010 Teucrium has exclusively offered access to alternative markets through ETFs. We revolutionized the way commodity ETFs are structured by tailoring our funds according to the unique characteristics of each underlying market.

Financial markets are ever evolving, and investors are constantly seeking better access to diverse markets and strategies. Teucrium continues to research and develop new products to further our mission of making alternative markets more easily accessible.