Corn May Be Next

Teucrium | March 8, 2022

Jake Hanley, Managing Director / Sr. Portfolio Strategist March 8, 2022

The Russian invasion of Ukraine completely upended the wheat markets. Front-month futures are up 50% since Friday, February 18th, the week prior to the invasion. Regular readers should not have been surprised to see wheat prices react to the upside as we’ve been writing about Russia/Ukraine tensions (see our 2022 Grain Outlook published last December, and our note “At Any Point,” published in January). Wheat is trading in a wartime market. War means uncertainty, and with uncertainty comes volatility.

Wheat has been front and center of the agricultural trade in the early days of the conflict. Yet, we suspect focus is beginning a shift towards considering additional market impacts. Corn may be the next crop to garner the market’s attention.

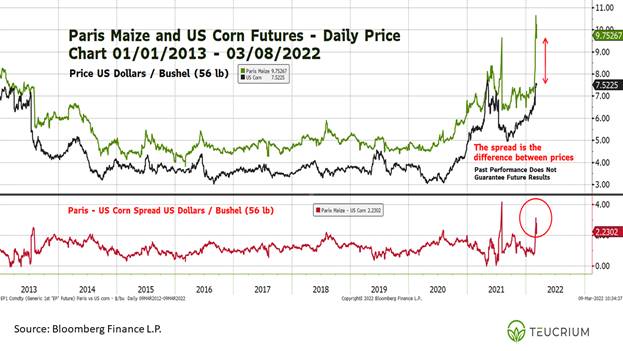

Consider that European corn (maize) prices recently made new all-time highs.[1] In fact, the price premium for European versus US corn prices jumped to over $3 per bushel for only the second time in the past 10 years. Prior to the war, Ukraine was expected to account for 16% of global corn exports. Markets are beginning to question whether that supply will be available come harvest.

Chart created by Teucrium 03/08/2022. This chart is for illustrative purposes only and is not indicative of any investment. Past performance does not guarantee future results. For this purpose, Paris Maize commodity values are representative of the futures (generic first corn futures contract - <EP1 Comdty>) spot continuation chart as defined by and sourced on Bloomberg: Generic contracts, such as EP1, EP2, EP3, ..., are constructed by pasting together "rolling" contracts, according to the pre-selected roll types on the commodity default page. The generic contract uses the value of a particular contract month until it "rolls" to the next month in the series. You can access a generic contract by replacing the month/year code with the number 1, i.e. EP1<CMDTY>. Replacing the month/year code with the number 1 will yield the spot contract.” Likewise, US corn commodity values are representative of the futures (generic first corn futures contract - <C 1 Comdty>) spot continuation chart as defined by and sourced on Bloomberg: Generic contracts, such as C 1, C 2, C 3, ..., are constructed by pasting together "rolling" contracts, according to the pre-selected roll types on the commodity default page. The generic contract uses the value of a particular contract month until it "rolls" to the next month in the series. You can access a generic contract by replacing the month/year code with the number 1, i.e. C 1<CMDTY>. Replacing the month/year code with the number 1 will yield the spot contract.”

Key Issues:

1. Stranded Shipments

2. Spring Planting

3. Autumn Harvest

4. Supply Chain

STRANDED SHIPMENTS

Ukrainian corn that was harvested in Autumn 2021 and committed for global export markets has not all been shipped and is now lost to world export markets due to the war and Ukraine’s newly placed ban on crop exports of all kinds until further notice.

PLANTING

US and Ukrainian corn farmers follow a very similar crop calendar. With planting season just around the corner, there is a concern that farmers may be off fighting the Russians rather than in their fields. You can’t reap what you don’t sow. As such, so long as the fighting continues, we expect that the trade will be paying close attention to Ukraine’s planting progress.

HARVEST

Similarly, harvesting corn is a labor-intensive process. Ongoing hostilities at harvest would likely give rise to concerns around labor force availability. Of course, a lot will happen between now and the harvest. Should a peace agreement be reached, the trade will then begin to assess the collateral damage looking for clues as to how quickly farming operations might return to normal. Damage to fields and equipment may hinder farmers’ ability to harvest efficiently.

SUPPLY CHAIN

To the extent that there is a successful harvest, the next challenge will be getting the crops to market.

War is destructive. Critical infrastructure is at risk of being damaged or destroyed. Here again, even after hostilities have ended the market’s attention will turn to assessing the damage to determine how long it will take to rebuild, and it is unknown when Ukraine’s ban on crop exports will be lifted.

In the meantime, Black Sea shipping activity is at a standstill. Ports are closed, and an estimated 200 vessels are stranded.[2] In short, the supply chain is broken, and there is no telling when it may be fixed.

Peace is Possible – Volatility is Likely

Commodity prices have rallied as market participants attempt to price in the uncertainty surrounding the fallout of war. Volatility has increased significantly. Please remember that volatility works both ways. Prices can fall as fast, if not faster than they rise. A peaceful resolution to the conflict in Ukraine would likely remove a good portion of uncertainty from the markets and may result in lower commodity prices.

Options are available on the Teucrium ETFs. Please consult with your broker for additional information.