Why Corn Prices Could Spark a Golden Harvest for Investors

Sal Gilbertie | October, 18 2024

Gold isn’t the only yellow commodity investors should look at for portfolio diversification. Corn can serve as both a stabilizer and a potential alpha generator. There are three key reasons why corn should be included in your investment strategy:

- History

of Corn’s Resilient Price Floor and Rallies

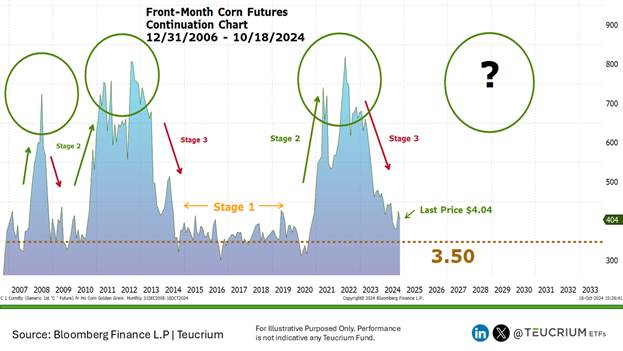

Since the Renewable Fuels Act was passed in 2006-2007, corn has shown consistent pricing patterns. The breakeven price for corn has hovered between $3.50 and $4 per bushel for the past 17 years. In that time, corn has risen from this range to over $7 per bushel on three separate occasions, essentially doubling its price each time.

The below chart is updated weekly and available to view on our website: https://insights.teucrium.com/golden-grain-cycle

Corn's price rarely falls below its breakeven range of $3.50 to $4 per bushel. In fact, aside from a brief six-month period during the COVID-19 panic, corn has never spent more than eight weeks below $3.50. Investors buying corn within this price range historically face a downside of only 10-15%, with the potential for 100% upside, as corn has doubled in price three times over the past 17 years. Currently, corn is trading around $4 per bushel, making this an attractive entry point for investors seeking both growth and diversification.

- Non-Correlation with the

S&P 500

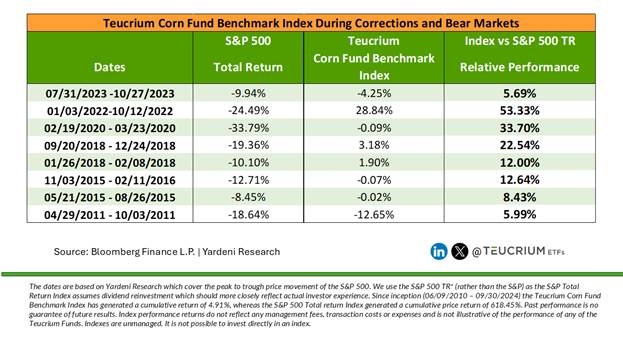

Corn has a low correlation with the S&P 500, meaning it can act as a portfolio diversifier, reducing overall risk. For example, since 2011, the Teucrium Corn Fund Benchmark Index, which has outperformed the S&P 500 Total Return index during all eight instances when the S&P declined by 10% or more. In some cases, the Teucrium Corn Fund Benchmark Index even posted gains while the S&P fell.

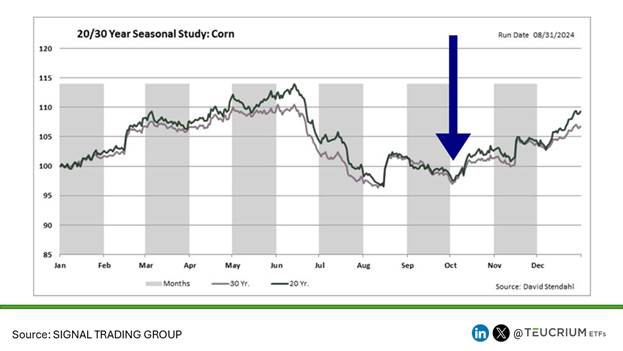

- Seasonal Low Advantage: Corn prices tend to hit their seasonal low each October, during the Northern Hemisphere’s harvest. This seasonal trend provides an additional signal for buying corn at the right time.

While past performance is not indicative of future results, the historical data shows that corn has consistently doubled in price from its current range. With inflation possibly raising the breakeven cost, corn remains near the bottom of the historical range, providing a limited downside risk and significant upside potential.

Investment Strategy

Unlike gold, corn isn't a set-and-forget investment. Gold is often used as a

long-term stabilizer, with investors holding it indefinitely. With corn, on the

other hand, investors may prefer taking an intermediate position capitalizing

on profits given the opportunity. An investor may weight corn in their

portfolio, wait for the upside (which often occurs during supply

disruptions such as droughts), and then sell. It’s a "wait for the

drought" strategy.

Corn as good as Black Gold?

Corn, like oil, i.e. black gold, should be considered when building a

commodity-based allocation. Just as investors are likely to consider taking a

position in oil as prices approach cost of production levels, so too should

they consider corn.

The analogy often used is that buying corn under $4 is like buying oil under $50 per barrel. Both commodities experience supply disruptions, and demand for both remains sticky because of their essential roles in food and energy production. For investors who buy oil when prices drop below $50, corn should be equally attractive when it's trading below $4.

Highly Liquid

Corn is also highly liquid. The notional value of corn traded per day is in the billions, making it easy for investors to enter and exit the market. No single investor or group of investors can manipulate corn prices due to the size of the market. Additionally, the price of futures based corn ETFs is directly influenced by the futures market, which is incredibly liquid and transparent.

The Takeaway

In summary, corn is a highly liquid investment, and when purchased at the low end of the 17-year price range, historically has low-downside and high-upside. Additionally an investment in corn that offers excellent diversification potential. Investors already allocating to gold and oil should seriously consider adding corn to their portfolios. Corn’s historical price patterns, seasonal trends, and low correlation with equity markets make it a smart strategic allocation.