Without Russian Wheat

Inflation, Drought, and the World’s Largest Wheat Exporte

Joran Haugens, Portfolio Manager

Jake Hanley, CMT Managing Director / Sr. Portfolio Strategist

Teucrium | October 10, 2024

Chicago wheat prices have advanced more than 20% from their August lows and may have another 15-20% upside amid developing Russian supply concerns.

Russia, Russia, Russia

Russia is the world’s largest wheat exporting nation. More than 1/5th of the global wheat trade comes from Russia. Russia has long been a key player in the global wheat trade, however, following the invasion of Ukraine Russia has demonstrated just how critical its wheat is for global markets.

At the outbreak of war in Ukraine there were concerns that the conflict would restrict market access to Black Sea wheat supplies. After initially spiking in 2022 wheat prices have been trending lower as those concerns never fully materialized. In fact, both Russian and Ukrainian wheat exports increased in the ’23-’24 crop year. Note, however, that Ukrainian wheat exports, while important, only account for 8% of the global market.[1] There is a tendency to lump Ukraine and Russia together and think of “Black Sea” wheat. In reality, the availability of Russian wheat matters more to the global wheat trade and prices worldwide.

Recently that availability is coming into question.

Ruining the Ruble

War is expensive and it is destructive. The war economy is good for jobs. Russian unemployment is a mere 2.4%.[2] However, the money Russia spends to produce an artillery shell at home continues circulating long after the artillery shell explodes in Ukraine. Ultimately this is inflationary and not good for the Ruble. As of August, Russian headline inflation is 9.1%.[3]

To combat rising inflation, the Bank of Russia raised its key interest rate to 19% in September, and indicated that another hike may be on the horizon.[4]

But there’s another problem. Russian food inflation is approaching 10%.[5] It’s unclear how high interest rates need to climb in Russia to have an impact on inflation, but it is unlikely that higher interest rates are going to have a meaningful impact on food prices. Food demand is rather in-elastic. People need to eat, high interest rates or not.

Without Wheat

The USDA projections show Russian wheat inventories at the lowest level in 10 years. Russia simply does not appear to have enough wheat to maintain the current export pace and adequately meet domestic demand.

There are two primary ways to rebuild supplies; produce more or use less. Of course, producing more is the preferred method.

There is some ambiguity surrounding Russian wheat production. Russia’s Agriculture Ministry is painting an optimistic production picture, but private sources suggest a much bleaker outlook.

On the production side, recent statements from the Russian Agriculture Minister provide reason for optimism. According to the Minister, winter grain plantings have reached 13 million hectares, and the country is on track to meet its target of 20 million hectares.[6]

However, private analyst SovEcon sees it differently. SovEcon reports Russia’s planting pace is at a decade low, and ongoing dryness in major wheat-producing regions has negatively impacted crop potential. These factors suggest that the Russian government’s projections may be overly optimistic.

Given the inelastic nature of food demand, it’s unlikely that Russians will use less. Instead, Russia is attempting to limit exports. On Friday October 11th Russia increased the wheat export duty by nearly 47%. While this will likely lower wheat prices within Russia, it would have the opposite effect on global markets, pushing prices higher as buyers seek alternative sources to fill the gap left by Russia.

The duration and magnitude of export duties depend largely upon the production issues discussed above. If SovEcon is correct, the delays in planting and adverse growing conditions could have significant consequences, both for Russia’s wheat output and for global supply in 2025.

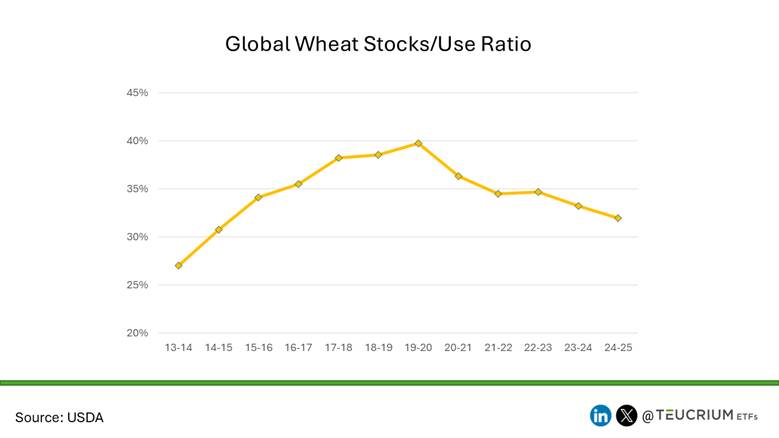

The global wheat market is already under pressure. In four of the past five years, the world has consumed more wheat than it has produced, leading to shrinking global supplies.

Pricing Expectations

The combination of global supply constraints and reduced exports from Russia could lead to higher wheat prices.

We believe there is an estimated 15-20% upside potential for Chicago wheat prices from current levels. The market has found support around $5 per bushel, and while a near-term retracement is possible, as long as prices don’t make new lows, a move toward $7 is possible.

Concurrently, front-month Chicago wheat has already advanced ~ 20% from the August lows. As such there is potentially a clear path lower from current price levels as well.

Wheat prices are volatile and that volatility works both ways. Should the supply picture develop better than expected, then we’ll likely see prices head lower. That however, is not our base case.

Conclusion

Russia’s struggle with inflation, potential production challenges, and export restrictions, are all fueling uncertainty in the global wheat market.

If private analysts are right about planting delays and adverse weather conditions, the likelihood of sizeable Russian export restrictions increases.

These restrictions would come at a time when the global wheat balance sheet is already tight, setting the stage for higher global wheat prices.

For now, all eyes remain on Russia as its internal and external policies shape the future of the global wheat market heading into 2025.