Commodity Market Update

Supply Chain Disruptions and Geopolitical Tensions

Jake Hanley, CMT Managing Director / Sr. Portfolio Strategist | April 08, 2024

|

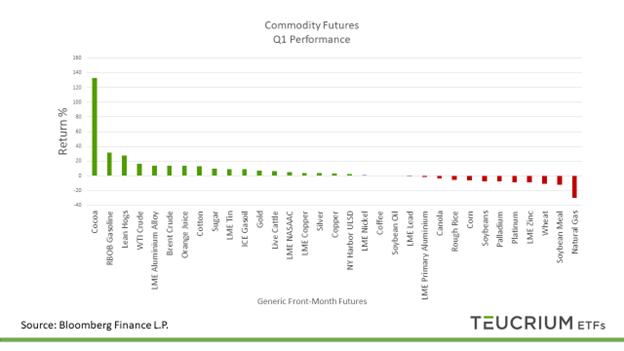

Being selective has paid off for commodities investors in 2024. Consider that Cocoa was the best performer with the front-month generic contract advancing more than 130%, and natural gas was the worst performer with the front-month generic contract dropping nearly 30%. Wide discrepancies as such create opportunities for active commodity traders. It was a big month for Gold as futures broke out to all-time highs, with the front-month generic contract jumping 21.42%. WTI crude was also positive in the quarter, up roughly 16%. Q1 was tough for the grain markets with front-month futures of corn, wheat, and soybeans all down 6% or more. |

|

|

In our 2024 Outlook, titled “Prosperity Paradox,” we published our base case view that 2024 would be a year of headwinds for commodities given growing supplies and slower economic growth. However, we highlighted three potential base-case disruptors, namely:

90 days into 2024 and our base case is unchanged. However, risks remain, and it is prudent for us to review the potential disruptors as we charge into Q2. |

|

The Fed |

|

The Fed has thus far proven to be the adult in the room holding rates steady. As we wrote last December, we believe that the Fed will err on the side of caution preferring to keep rates higher for longer rather than risk helping usher in another wave of inflation. The data has been mixed recently and given the Fed’s proclaimed data dependence; we’re not surprised by the inaction. To date, the Fed has not disrupted our base case. |

|

Weather |

|

Cocoa’s historic price advance is directly related to weather-related production issues in Western Africa. However, we have observed minimal weather impact beyond cocoa on the other markets we monitor most closely. While dry conditions in South America, especially Brazil, have significantly impacted soybean production and raised concerns about the safrinha corn crop, the potential impact on the global balance sheet appears to be marginal. Note, there is a wide discrepancy between the Brazilian agricultural agency (CONAB), expecting lower corn and soybean production, and USDA projections.[1] Still, we would not expect a significant price impact, even if the actual production figures come out closer to CONAB’s projections. |

|

Supply Chain Risk |

|

Thus far, our base case has been most challenged by the uncertainty surrounding supply chains given geopolitical tensions and war.[2] The advance in crude and new all-time highs in gold has coincided with escalation in the two primary areas of conflict, the Middle East, and Eastern Europe. Beginning with the Middle East. Israel, while engaged in a campaign to eradicate Hamas from the Gaza Strip is also being attacked by Hezbollah in the North. Additionally, Houthi rebels have been attacking commercial vessels in the Red Sea, resulting in the loss of millions of dollars in property and time as shippers re-route to avoid the Red Sea entirely. Of course, armed conflict in the Middle East naturally supports oil prices. The increasing threat of broader conflict involving a direct Israel/Iran confrontation further justifies higher energy prices. Still, given the orderly advance of crude oil futures, traders appear to be pricing in the uncertainty of a supply shock. To be certain, the shock has not yet arrived. Still, the likelihood of an oil price shock increases as the fighting continues and tensions escalate. |

|

|

Watch for continued violence in the Red Sea and of course any escalation in fighting between Israel and Hezbollah, as well as direct engagement with Iran. It's not only conflict in the Middle East, but also war in the Black Sea region that threatens to send energy prices higher. Ukraine has demonstrated the ability to successfully attack deep within Russian territory. Recent attacks have targeted refineries, with Reuters reporting that up to 15% of Russian refining capacity has been impacted.[3] In addition, Ukraine has effectively rendered Russia’s Black Sea naval dominance impotent, meaning Black Sea crude oil exports from Russia (the world’s second-largest crude oil producer) could also be threatened. The United States has vocally opposed these attacks citing concerns about Russian retaliation and the impact on energy prices.[4] Implied is that the U.S. would like for Ukraine to prevail over Russia, but not at the cost of higher energy prices, at least not during election season. Ukraine’s ability to disrupt Russian refining capacity is a meaningful advantage that could help tip the scales in Ukraine’s favor. At a minimum, it could provide Ukraine some leverage at a negotiating table when establishing the terms to end this conflict. Russia may be more apt to reaching a settlement and cede some points to Ukraine rather than risk continued drone attacks. Furthermore, while the Ukrainian war effort is largely dependent on U.S. financing there is the risk that funding ends or is curtailed dramatically following U.S. elections. As such, perhaps Ukraine will continue with the attacks even without U.S. support as there is the possibility that they lose funding anyway. Ukrainians are fighting for survival. It seems reasonable to assume that they will press every advantage they have. If that results in higher energy prices for American consumers, so be it. Of course, escalating violence between Russia and Ukraine poses a risk for agricultural markets as well. Some have attributed the recent strength in wheat to concerns over Russian exports. Importantly the concerns were not related to the war but rather a dispute between Russian officials and a major commercial exporter. Still, the incident brought to focus the importance of Russian wheat exports. Remember, Russia is the leading exporter of wheat globally, contributing 24% to global exports, while Ukraine makes up about 8%. Consequently, the availability of Russian wheat is of greater concern to the markets compared to Ukrainian wheat. However, the situation reverses for corn. Ukraine plays a significant role in corn exports, representing more than 12% of the global share. Many are often surprised to discover that Ukrainian corn exports hold more significance to global trade than Ukrainian wheat exports. In addition to Ukrainian strikes on Russia's energy infrastructure, we’re watching for a potential risk premium to build in ag markets amid continued attacks on key ports. On the Russian side pay attention to the major grain exporting ports of Novorossiysk and Kavkaz. In Ukraine watch for attacks on Odesa and Danube River ports. |

|

|

The Trend is Your (backstabbing) Friend |

|

"The trend is your friend" is a heuristic used by traders and investors to remind themselves that it is often easier and potentially more profitable to make trades that align with the current market trend, rather than going against it. The rationale behind this heuristic is that financial markets tend to move in trends (upward, downward, or sideways) over time, and these trends can persist longer and go further than one might expect. By aligning their trades with the trend, traders are hoping to capitalize on the momentum of the market. The fact is that the “trend is your friend” until it isn’t. Since June of 2022, commodities have primarily been trending lower. The Bloomberg Commodity Index (BCOM) is down 27% since peaking in June of 2022. The opposite has been true for stocks with the S&P 500 Total Return Index advancing more than 30% over the same period. The beginning of a new quarter is a popular time for traders and investors to evaluate their positions as they consider rebalancing and/or reallocating their portfolios. Considering the recent robust performance in the oil and gold markets, investors might consider boosting their commodity allocations in the second quarter. The potential for substantial inflows into commodities grows, especially if the momentum in the stock market begins to falter. In that case, a broader subset of commodities, including some of the most beat-up markets, such as wheat, may catch a bid. |

|

Conclusion |

|

While our base case for 2024 remains unchanged, risks remain. Of the three largest potential disruptors (the Fed, weather, and supply chains), supply chain risk due to geopolitical conflict and war currently poses the greatest threat. Recent moves in oil and gold markets suggest that traders continue to price in geopolitical uncertainty. Furthermore, it's important to remember that trends are not eternal. Commodities, after enduring a broad downturn over the past 18 months, may soon regain their appeal among investors, especially if equities face challenges. However, within the commodities sector, performance will vary, with some assets outshining others. It's an open question whether some of the poorest performers, like wheat, can make a turnaround and ascend to the ranks of top-performing commodities. Stay tuned. |

|

[1] According to the projections released in March, USDA expects Brazilian soybean production at 155 million metric tons (mmt) compared to CONAB’s projection of 146.9 mmt. The difference of roughly 8 mmt equates to 294 million bushels. For corn the gap is even larger with the USDA projecting production of 124 mmt. Compared to CONAB’s expectation of 112.8 mmt. Converting to bushels the difference equates to 440 million bushels. [2] Trading Uncertainty - An uncertainty premium can only take prices so far. At some point traders will become comfortable that the risks are adequately priced in. Using crude oil as an example, whether that means WTI at $90 per barrel, or $100 is anyone’s guess that the moment. The point is that prices do not climb a wall of worry forever. What’s more, uncertainty resolves in one of two ways. Either the anticipated risk event is realized, or the risk of the event abates. Even so there is no guarantee that the event itself will prove to be bullish. The adage “buy the rumor, sell the news,” speaks to the fact that sometimes the market climbs a wall of worry, generating paper profits, which traders look to realize promptly by selling as the anticipated event unfolds. [4] https://www.ft.com/content/98f15b60-bc4d-4d3c-9e57-cbdde122ac0c |